Bond ladder calculator

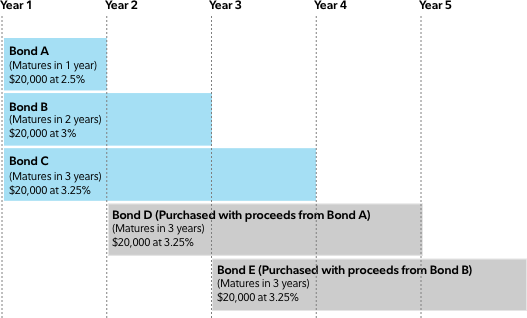

When the first bond matures in 2 years you reinvest the money in a bond with a 10-year maturity maintaining the ladder youve constructed. A bond ladder can help investors earn a steady stream of income from their security holdings while increasing the potential for greater returns should interest rates rise in the future.

Climbing The Wealth Ladder Wealth Freedom Travel Data

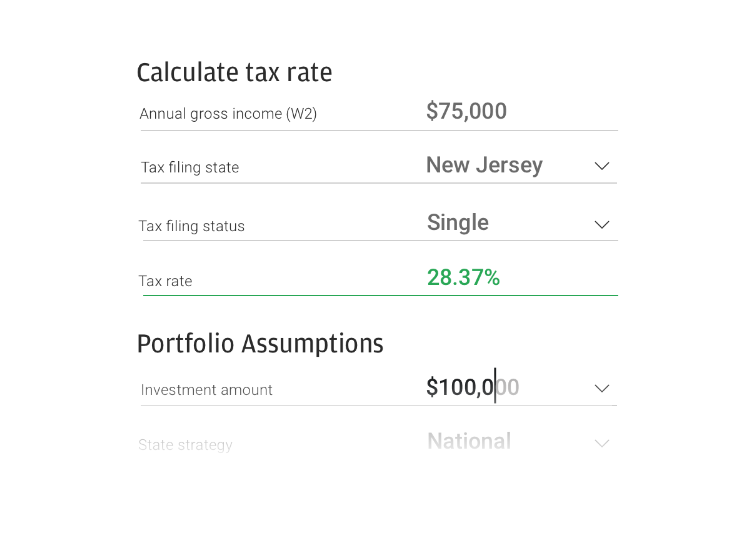

Explore personal finance topics including credit cards investments identity.

. The Denomination field in that calculator is based on the denominations of paper savings bonds. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan. Generic 10-year Treasury Yield USGG10YR INDEX.

If theyre lower the ladder still includes. A bond ladder is a portfolio of individual bonds with different maturity dates. 833 x 6 percent market rate 4998.

Based on EPS estimates Ladder Capital will have a dividend payout ratio of 11000 in the coming year. If you need long term funding on Equity Trades Discount Brokerage Savings Calculator. A Beginners Guide.

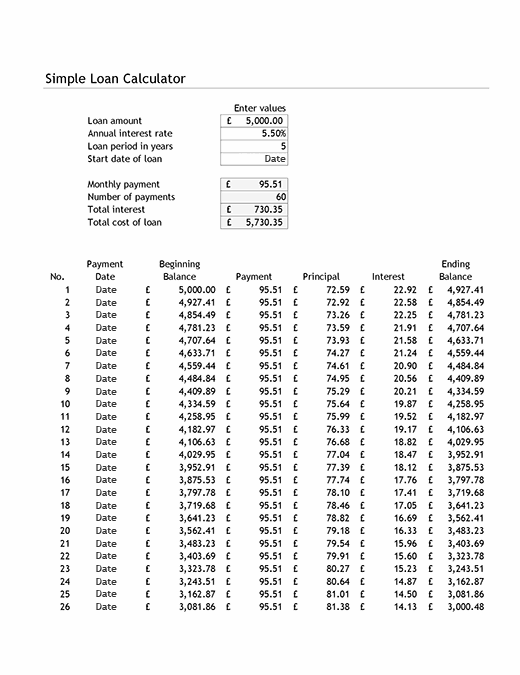

It works on a standard repayment term of 20 years and also tells you the total amount repayable over the term of your loan. Say your ladder has bonds that mature in 2 4 6 8 and 10 years. New 6-Month Bill est.

A bond ladder is a portfolio of individual bonds that mature at different rates. For new fixed ladders erected on or after November 19 2018 the employer must equip the ladder with a ladder safety or personal fall arrest system. The dividend payout ratio of Ladder Capital is 11000.

Reduced bond value. 191028b9iB For ladder repairs and replacements when an employer replaces any portion of a fixed ladder the replacement must be equipped with a ladder safety or personal fall arrest system. This will provide the amount of moulding needed for the project.

And since many bonds generally pay out twice a year on dates that coincide with their maturity date monthly bond income can be structured around those dates. By contrast if you purchase a 1000 bond with an interest rate of 5 percent and rates fall to 4 percent your bond will increase in value until they can be purchased at a price that will result in an interest rate that approaches 4 percent. The actual rate of return is largely dependent on the types of investments you select.

Payout ratios above 75 are not desirable because they may not be sustainable. The staggered maturity dates help reduce risk if interest rates fluctuate. Purchase your selected bonds and CDs even your complete bond ladder online in one easy step.

It is also helpful to sketch the room while noting dimensions. Retirement plan income calculator. The issuer credit quality is excellent but.

For the past 50 years it was 711. Ladder Capital has only been increasing its dividend for 1 years. The Bureau is proposing a price-based approach because it preliminarily concludes that a loans price as measured by comparing a loans annual percentage rate to the average prime offer rate for a comparable transaction is a strong indicator and.

The Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach. Each rung of the ladder represents a bond. 28 and 5-Year Government Bond est.

With this simple bond ladder you would have 5000 to reinvest each year. Start by measuring the length of each wall and be sure to subtract any doors windows or openings. A bond ladder strategy can be an effective way to average into the market.

If you need multi leg Option trading Good till trade order Basket Order Cover Order Spread Order Ladder Trading. A good suggestion may be to form some sort of treasury bill ladder. 275 Issue on 1st September 2022.

Using the 10-Year Treasury Bond as a proxy and again using figures reported by the NYU Stern School of Business the average annual return over the past 20 years was 531. The TreasuryDirect calculator for paper savings bonds has a field for Bond Serial Number. While that may sound complicated in practice it is much easier than it seems.

Confused1 responding to your Comment 6. Heres one way you could build a CD bond ladder immediately. A bond ladder is a classic passive investment that has appealed to retirees and near-retirees for.

Conveniently view open orders for fixed-income investments along with those for equity products on the TD Ameritrade home. 20000 into a 1-year CD. This calculator assumes that your return is compounded annually and your deposits are made monthly.

In other words bond highs arent as high but their lows arent as low either. 10-year Treasury yields may have peaked in June Source. Credit Card Interest Calculator.

It uses the purchase price of the property and the current interest rate to tell your home loan amount and monthly repayment. Daily data as of 6302022. Add 15 to each wall to allow for miter cuts and waste.

The Standard Poors 500 SP 500 for the 10 years ending December 31 st 2018 had an annual compounded rate of return of 121 including reinvestment. If interest rates are higher you gain the advantage of better yields. Build your own bond ladder using powerful portfolio analysis tools evaluating average price yield coupon rate and cash flow.

Our bond repayment calculator helps you plan and budget. As each bond matures you can reinvest the principal at current interest rates. The calculator works perfectly fine if you make no entry in that field.

The other issue is a longer tenor government bond issue.

Bond Ladder Illustrator J P Morgan Asset Management

Bail Bond Calculator Instructions On How It Works Bail Bondsman Bail Instruction

Simple Loan Calculator And Amortisation Table

Best Investing Podcasts Investing Podcasts Investment Portfolio

Rich Broke Or Dead Post Retirement Fire Calculator Visualizing Early Retirement Success And Longevity Risk Engaging Data

Individual Savings Bond Calculator Inventory Instructions

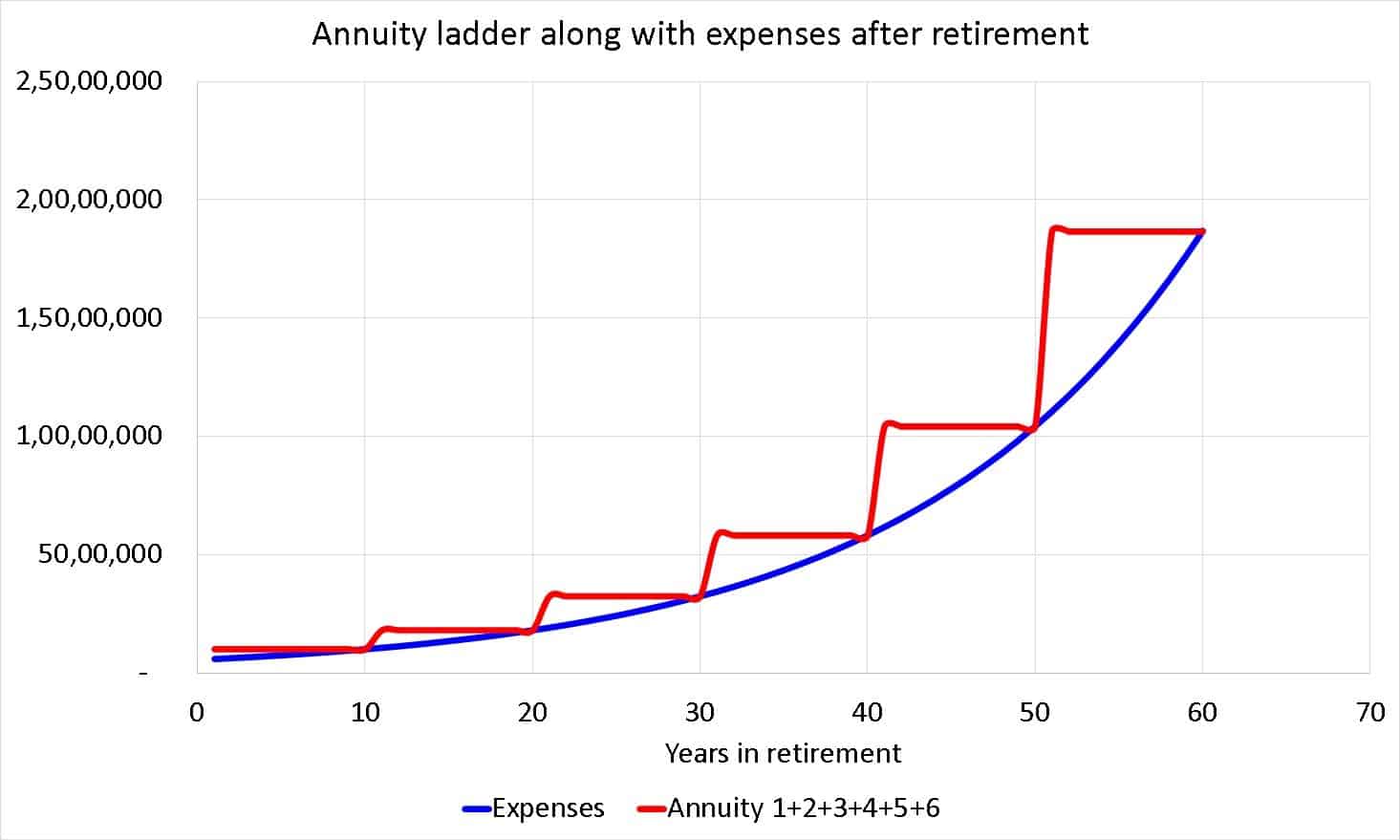

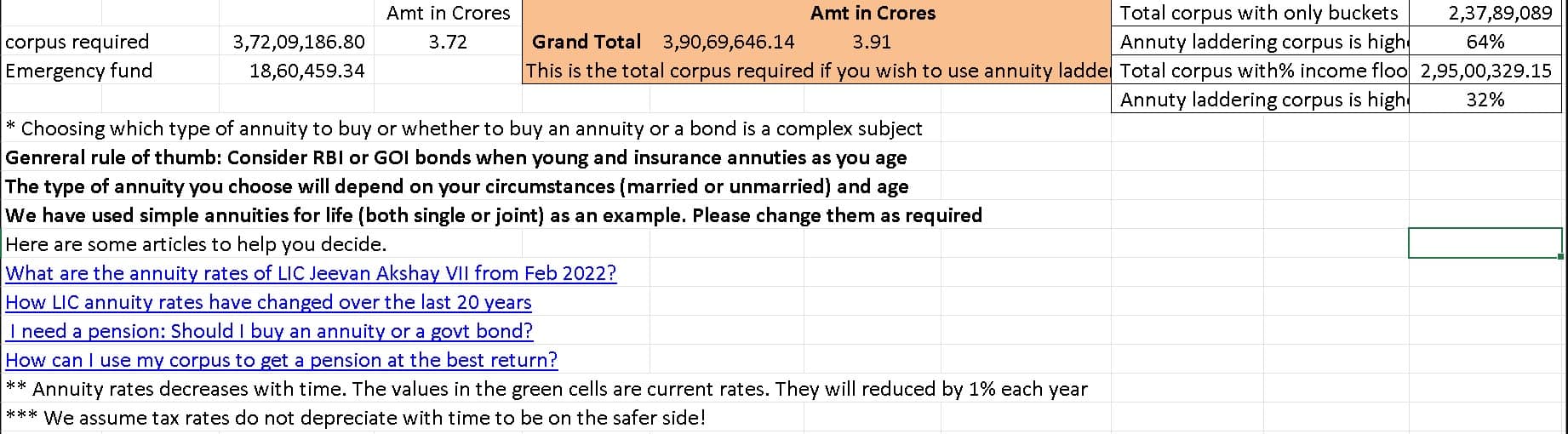

Use This Annuity Ladder Calculator To Plan For Retirement

Bond Yield Formula And Calculator Excel Template

Bond Yield Formula And Calculator Excel Template

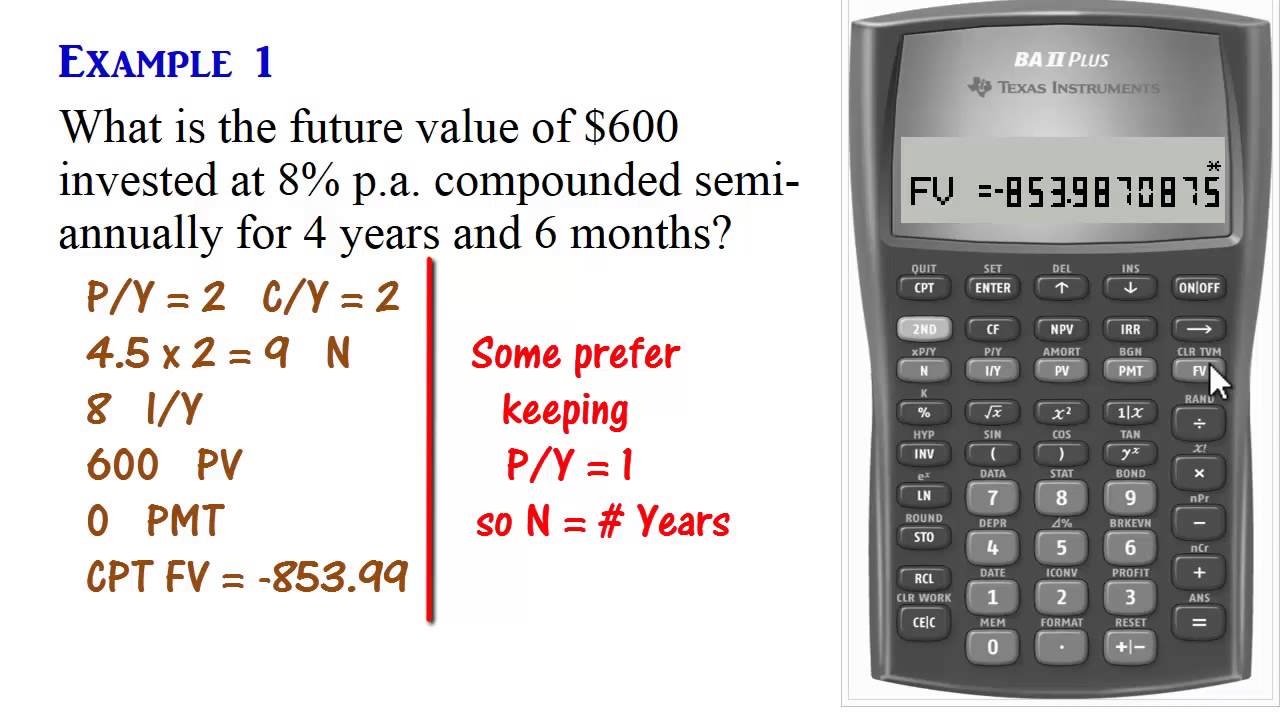

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

Laddered Investing Interest Rate Scenario Tool Eaton Vance

Fixed Income Strategy For A Tightening Monetary Policy Seeking Alpha

Pay Off Mortgage Vs Invest Calculator

Bond Ladder Tool From Fidelity

Municipal Bond Ladder Calculator Tools Nuveen

Use This Annuity Ladder Calculator To Plan For Retirement

Excel Dividend Calculator Calculate Your Dividend Income